Medical insurance is one of the most important tools you can have to protect yourself from unexpected healthcare expenses. With rising medical costs in the USA, having the right insurance coverage can make a significant difference in ensuring you receive the care you need without the financial burden. This comprehensive guide will help you understand medical insurance options, compare rates from different providers, and discover the benefits of having proper coverage.

Why Medical Insurance is Essential in the USA

Healthcare in the USA is notoriously expensive, and medical insurance is essential for covering costs such as doctor visits, surgeries, hospital stays, and prescription medications. Without insurance, even a routine medical issue could result in significant financial strain.

Here’s why medical insurance is crucial:

- Protects against high medical costs: Insurance helps cover unexpected expenses, like emergency room visits or surgeries.

- Access to better care: With coverage, you are more likely to access preventive services and routine care, which helps avoid larger health issues.

- Peace of mind: Knowing that you are financially protected in the event of a medical emergency allows you to focus on getting the necessary care.

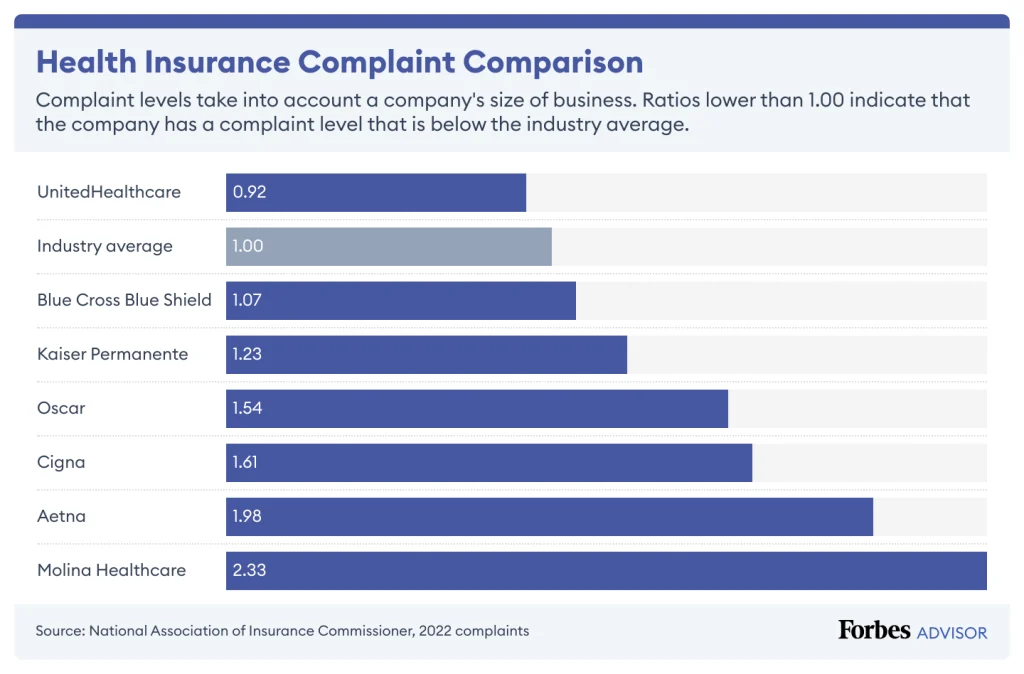

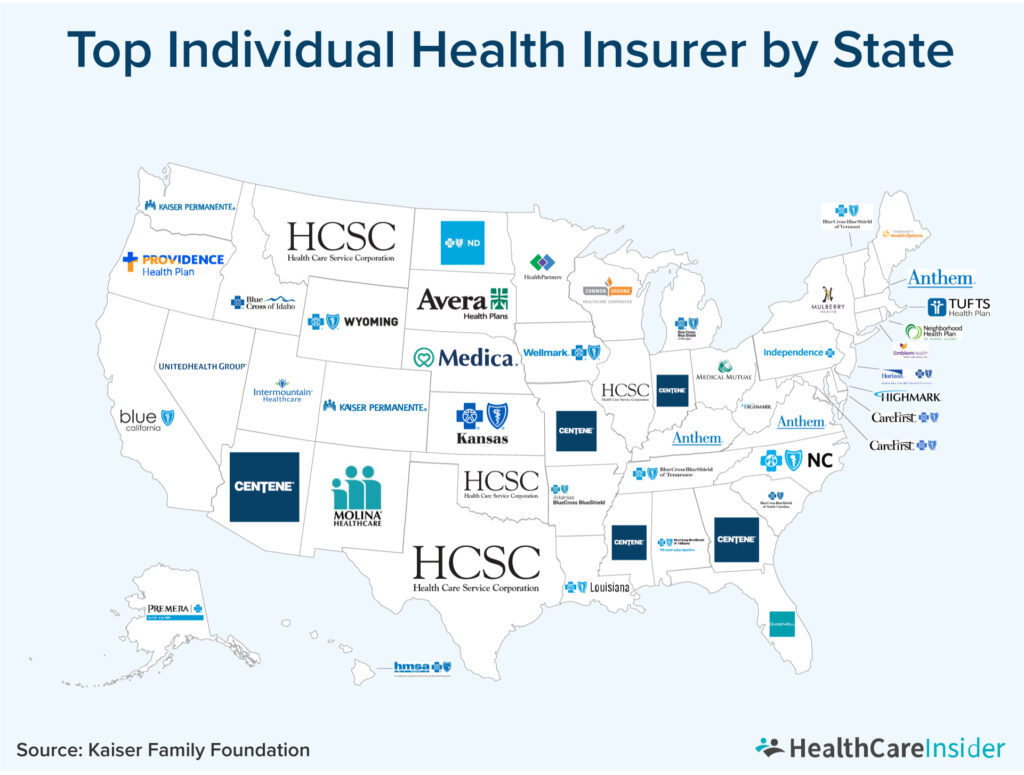

Comparison of Medical Insurance Providers in the USA

With so many providers offering medical insurance plans, it can be overwhelming to choose the right one. Below, we compare some of the top insurance companies based on monthly premiums, coverage options, and benefits.

| Provider | Coverage | Monthly Cost | Deductible | Key Features |

|---|---|---|---|---|

| Blue Cross Blue Shield | Doctor visits, hospital stays, prescriptions | $300 – $600 | $1,500 – $5,000 | Nationwide network, customizable plans |

| Cigna | Preventive care, specialist visits, medications | $250 – $550 | $2,000 – $4,000 | Low co-pays, 24/7 virtual care |

| Kaiser Permanente | Preventive care, hospital stays, wellness | $200 – $500 | $1,000 – $3,500 | Integrated healthcare system, wellness perks |

| Aetna | Doctor visits, mental health, prescriptions | $275 – $600 | $1,500 – $5,500 | Telehealth services, HSA options |

| UnitedHealthcare | Hospital stays, emergency services, prescriptions | $320 – $650 | $2,500 – $6,000 | Large provider network, wellness programs |

When comparing these providers, it’s important to consider:

- Monthly Premiums: Your monthly payment will vary depending on the level of coverage you need.

- Deductibles: This is the amount you pay out-of-pocket before insurance starts covering costs. Lower deductibles mean higher premiums.

- Coverage: Check whether the plan covers essential needs like doctor visits, hospital stays, prescriptions, or mental health services.

- Network Size: Make sure your preferred healthcare providers are in-network for the insurance plan you choose.

Benefits of Having Medical Insurance

Medical insurance provides numerous benefits, protecting both your health and finances. Let’s look at some of the most significant advantages:

1. Access to Preventive Care

Most medical insurance plans offer free preventive services, including annual check-ups, screenings, and vaccinations. This helps catch health issues early, preventing them from becoming more serious and costly.

2. Financial Protection

Medical emergencies, surgeries, or chronic illnesses can lead to high medical bills. Having insurance ensures that a large portion of these costs is covered, reducing your out-of-pocket expenses.

3. Prescription Drug Coverage

Many insurance plans include coverage for prescription medications, which can be a huge benefit for individuals with ongoing medical conditions that require regular medication.

4. Mental Health Services

More and more insurance providers are offering mental health coverage, which can include therapy, counseling, and psychiatric medications.

5. Better Quality of Care

People with health insurance are more likely to get timely medical care, leading to better health outcomes. You’ll have access to specialists, better treatment options, and preventive services that can improve your overall well-being.

How to Choose the Right Medical Insurance Plan

Selecting the best medical insurance plan depends on various factors, including your health needs, budget, and preferred providers. Here are some tips to help you make the right decision:

- Assess Your Health Needs: If you have chronic conditions, make sure the plan covers specialist visits and necessary treatments.

- Budget for Premiums and Deductibles: Choose a plan that fits your monthly budget, but also consider the deductible. Plans with lower deductibles may have higher monthly premiums, but they’ll cover more sooner.

- Check the Provider Network: Ensure that the plan includes hospitals and doctors you trust. A large network provides more options.

- Consider Additional Benefits: Look for extra perks like telehealth services, wellness programs, or health savings accounts (HSAs) that can help you save money on medical expenses.

Final Thoughts on Medical Insurance in the USA

Choosing the right medical insurance plan is crucial to protecting both your health and finances. By comparing rates and coverage options, you can find the plan that best fits your needs. The real-time API tool embedded in this guide will help you get up-to-date rates from various providers. Remember to factor in your specific health requirements, the monthly premium, and deductible when making your decision.

Having the right medical insurance provides peace of mind and ensures you have access to high-quality healthcare whenever you need it.

For more details on medical insurance, Click Here

For Pet Insurance Details, Click Here